New Interconnectors could lower costs to customers

Australia’s electricity transmission grids are facing a “new era” according to the Australian Energy Market Operator (AEMO), when the focus will shift increasingly from providing capacity to maintaining ‘system support services’.

_______________________________

Woody Allen was fond of saying, “If you want to make god laugh, tell him about your plans”. Even so, evidence-based planning can provide key insights to Australia’s efficient energy transition given dynamic changes in the energy system yet long-lived generation, network and customer-owned infrastructure.

This week, AEMO produced its significantly revised National Transmission Network Development Plan (NTNDP) for the next twenty years. Its most significant change in assumptions is the incorporation of the Victorian Renewable Energy Target[1] and the requirement for the Australian Government to achieve its COP 21, Paris Agreement commitments to a 26 to 28% reduction in 2005 CO2 emission levels by 2030.

Like the Electricity Network Transformation Roadmap released last week, AEMO finds that Australia’s electricity system is facing profound changes with implications for the Grid. It predicts that:

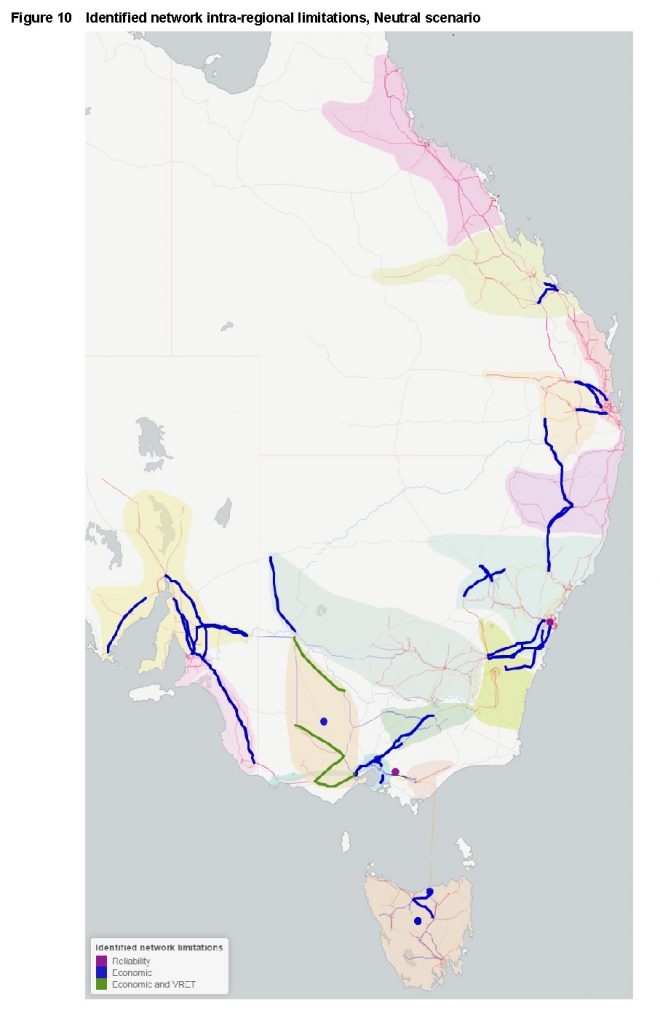

- Up to 22,000 MW of new large scale wind and solar generation will be connected in the next 20 years and it will connect in areas with high renewable resources, which tend to be weaker parts of the grid designed to supply only local load[2];

- Coal-fired generation will fall from 75% to about 24% of National Electricity Market (NEM) output by 2035/36, requiring new sources of frequency and voltage support

- Approximately 9,000 MW of coal generation will reach its technical end of life in the 2030s.

Whether coal-fired generation is refurbished or replaced depends on carbon policy, technology costs, consumer demand and future gas prices. This creates enormous uncertainty for emissions abatement outcomes, the generation mix and Australia’s gas market – a 10,000 MW difference in gas-fired generation leads to a 50% difference in domestic annual gas consumption in 20 years.

AEMO concludes that transmission networks will evolve from being focussed on growth to meet capacity services to system support services such as frequency and voltage support, important to reliable and secure energy supply.

Assessing the implications of the Victorian Renewable Energy Target and other Federal and State policies, AEMO concludes that:

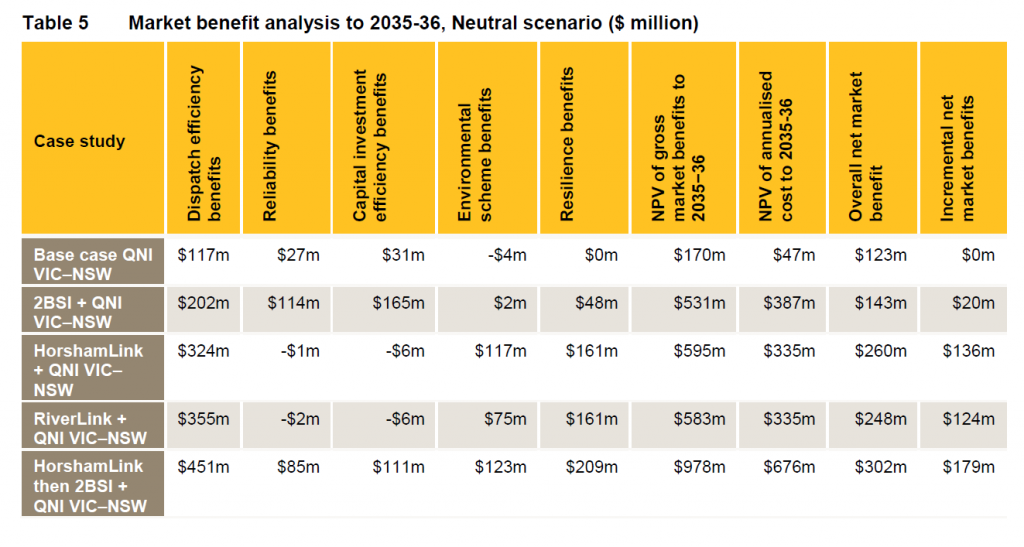

- Without new transmission infrastructure, the Large Scale Renewable Energy Target (LRET) targets are at risk in the next 5 to 10 years. AEMO identifies that current inter-regional and intra-regional transmission constraints and the low power system inertia conditions in South Australia will see significant amounts of “spill” or wasted output from wind turbines. New interconnection would help to avoid retailers paying the LRET penalty price. (This provides the Environmental Scheme benefits identified in AEMO’s Table 5 below).

- Victoria requires between $1 billion to $3 billion to facilitate the connection of new renewable generation to accommodate the VRET.[3] The report identifies at least four significant network limitations where single circuits would require duplication or other works to reduce generation curtailment and meet VRET target, or in some cases avoid load curtailment when support from neighbouring states is insufficient.

Important Role for Interconnectors

AEMO’s updated analysis highlights the importance for customers of a more interconnected NEM, with the benefits of transmission investments increasing as the energy transformation accelerates.

“Geographic and technological diversity smooths the impact of intermittency and reduces reliance on gas-powered generation (GPG). Greater interconnection facilitates this diversity and delivers fuel cost savings to customers.” AEMO, NTNDP 2016, page 3.

While identifying clear quantifiable benefits to electricity customers from development of interconnectors, AEMO notes that they would need to be subject to rigorous analysis and stakeholder engagement through the regulatory investment test, which would also assess non-network solutions.

However, it is finds six potential interconnector scenarios would have a positive Benefit to Cost Ratio (BCR). This preliminary assessment indicates that these interconnectors would more than pay for themselves, resulting in downward pressure on customer bills which are otherwise exposed to higher wholesale energy costs. The cost savings provided to customers – including by allowing access to more efficient generation sources – would offset the cost of the infrastructure investment.

The six scenarios include improved interconnection to New South Wales (mid to late 2020s), between South Australia and Victoria or South Australia and New South Wales (2021); and a second Bass Strait interconnector (2025); Synchronous Condensors in South Australia (2021); or combinations of the above.

The AEMO analysis indicates that there would be significant generation dispatch efficiencies and/or savings in generation investment with timely interconnection. In the case of South Australia, an interconnector would provide significant consumer and market benefits[4], including:

- net market benefits of $124 to $136 million over the next 20 years;

- greater access to lower cost fuel supplies at times when intermittent generation in the region was low; and

- a reduced likelihood of a widespread blackout in South Australia by mitigating the possibility of ‘separation’ events – where the region is challenged to operate as an island, without relying on synchronous operation with the NEM. AEMO estimated overall net economic benefits of $161 million in resilience benefits in South Australia.

AEMO emphasised that its assessment was not intended to replace the need for the regulatory standard assessment for Transmission investment. ElectraNet recently initiated its analysis of Interconnector options and non-network solutions. ElectraNet’s study is assessing the potential benefits of solutions for system security of consumers and producers of electricity through:

- allowing the Rate of Change of Frequency (ROCOF) standard to be met without constraining flows over the Heywood Interconnector;

- further reducing the risk and/or consequences of supply disruption following a separation or other event, through reducing RoCoF below the mandated standard;

- managing the challenges of declining system strength (fault levels); and/or

- allowing greater sharing of ancillary services across regions, resulting in an overall lower cost of providing system stability.

AEMO notes that the interconnector investments would be significant and need to be rigorously assessed through the Regulatory Investment Test – Transmission (RIT-T) framework, which is under review. Its report also supports contestability to increase the efficiency of transmission capital infrastructure investment.

However, the market operator also puts these grid investments in perspective – compared to their projected benefits and total system costs, noting that for one particular scenario:

“Total project capital costs are about $1.6 billion in this case, as it includes augmentation of QNI and NSW–VIC as well as the additional South Australia and Bass Strait interconnectors.

This is equivalent to a NPV of $676 million over the next 20 years, when costs are annualised assuming a weighted average cost of capital of 8.76% and a 50 year asset life. For comparison, the NPV of capital expenditure on new generation over the same period is estimated to be $16.4 billion.

AEMO’s Plan is produced in its capacity as the independent national transmission planner, taking into account the long-term interests of NEM consumers. AEMO indicates it sees the NTNDP as the vehicle to bring together a range of industry stakeholders to facilitate a co-ordinated, national approach to long-term network planning.

[1] VRET specifies renewable energy will represent 25% of total Victorian generation in 2020, rising to 40% by 2025

[2] Page 4, AEMO, NTNDP 2016

[3] AEMO, NTNDP, page 23.

[4] These positive benefits exclude consideration of competition benefits, or changes in additional option value. The latter concept recognises the value of adapting an investment strategy over time, in response to learning about future uncertainties. It is a recognised assessment technique for large projects with phased stages, and has been included as a benefit category in the RIT-T since 2009. Interconnectors may have substantial option value in the light of the uncertainty surrounding new technologies and the future development of electricity supply and demand.