Delivering for customers: network report card

The AER has released a new report that assesses electricity networks’ performance. We take a look at whether customers are now receiving more services for less cost, and the importance of incorporating emerging issues into investability analysis.

What does the report cover?

The Australian Energy Regulator’s (AER) Electricity Network Performance Report 2020 looks at key trends in operational and performance data of electricity distribution and transmission network service providers (NSPs) in the National Electricity Market (NEM) up to 2019.

It is focused on the provision of regulated services by electricity networks to customers delivered under the regulated revenue cap set by the AER. Electricity networks are regulated through an incentive-based system that continuously encourages networks to find better ways to efficiently serve customers.

Under the current approach, the AER determines the allowed revenue a network business can recover from its customers before the start of each five-year regulatory period for which that revenue allowance applies. Incentive regulation is designed to replicate the forces of a competitive market and encourage regulated businesses to manage costs and improve efficiency over time, without compromising the standard of service to customers.

Electricity networks’ report card: delivering more for less

The AER’s report confirms that electricity networks are delivering customers better service for less cost. In the report, the AER observes “consumers are getting a more reliable supply of electricity and paying less for this supply than they have previously.”[i], with the findings welcomed by the AER Chair.[ii]

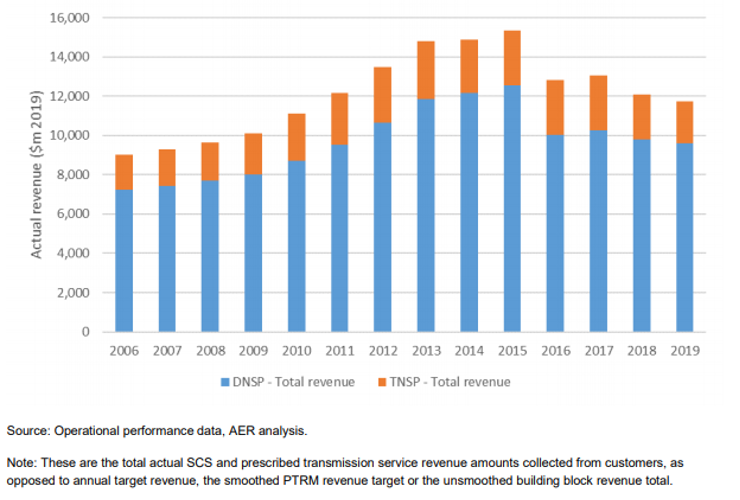

The report shows that in 2019, customers spent less in total on core regulated network services than they have in any year since 2011. This continues a general trend of declining regulatory revenues since 2015. These falls, shown in Figure 1 below, are largely driven by reductions in allowed rates of return in decisions already made.

Figure 1: Total core regulated network service revenue recovered from customers – DNSPs and TNSPs[iii]

Despite this declining revenue, the AER has found that distribution network reliability has generally improved in recent years, clearly demonstrating that networks are working hard at delivering more for less.

The AER’s analysis concludes that over time customers have experienced fewer distribution network outages and that over time the duration of these outages (measured via the system average interruption duration index (SAIDI)) has also followed a general trend of improvement.

The limits of historical reporting

The AER also reports on profitability measures and concludes that while actual network profits have declined over time, investors appear to view the expected returns from investing in regulated networks as being at least sufficient to attract investment.

It is important to note that the measures given in the report provide a ‘rear vision mirror’ view of network investment incentives. Focusing exclusively on the measures reported risks missing critical emerging issues around investibility for new capital projects and the overall adequacy of network investment incentives.

Recent AER decisions have effectively more than halved real regulatory returns to shareholders and regulatory inflation assumptions – challenged by unprecedented global conditions – have also contributed to recent determinations that deliver, based on the AER’s own numbers, negative profit after tax going forward.

These are unsustainable outcomes which risk poor customer consequences from a lack of strategic grid development in the years ahead.

Areas of future focus

The AER has indicated that in future reports, it intends to improve its reporting tools on incentive scheme outcomes, seeking to better understand the effect that those schemes are having on NSP outcomes. Energy Networks Australia’s Rewarding Performance: How customers benefit from incentive-based regulation report found that regulated energy networks operating under incentive schemes over the past 13 years will deliver an estimated $6.3 billion of additional benefit to Australian energy customers.[iv]

The AER’s Network Performance Report looks at the operation of the Capital Expenditure Sharing Scheme (CESS). The CESS provides customers with a share in capex savings and is designed to establish an even financial incentive for networks to make capex efficiency gains through a regulatory period, i.e. to remove any expenditure timing incentives. Before any future conclusions about the timing of capital expenditure and interaction with the CESS are made, external factors that may influence that expenditure need to be considered and incorporated into this analysis. There are clear customer benefits to the AER’s incentive schemes.

The AER has also foreshadowed that similar performance reports will be prepared in future for the full regulated gas pipelines.

This industry snapshot clearly demonstrates that electricity NSPs are delivering customers better service for less cost.

References

[i] Australian Energy Regulator, Electricity Network Performance Report 2020, September 2020, Page 2.

[ii] Australian Energy Regulator, Media Release: New report assesses electricity networks’ performance, 17 September 2020.

[iii] Australian Energy Regulator, Electricity Network Performance Report 2020, September 2020, Figure 3-1, Page 9.

[iv] Energy Networks Australia, Rewarding Performance: How customers benefit from incentive-based regulation, July 2019.