What does an “actionable” Integrated System Plan mean?

Further to instructions from its August meeting, the COAG Energy Council last week progressed some important energy matters with Energy Security Board (ESB) taking much of the lead:

- Australian Energy Market Operator (AEMO) highlighted that additional measures are required to support future reliability including further transmission and interconnections;

- It was agreed there needs to be a focus on the Integrated System Plan (ISP), the ESB will develop an implementation plan and clear recommendations for actions, including any rule changes required for the December COAG meeting;

- ESB will further the draft Strategic Energy Plan presented on the overarching guidance on the operation and evolution of energy markets in Australia.

In August, the COAG Energy Council asked the ESB to consider how the ISP could be turned into an “actionable strategic plan”. Actionable can mean “giving sufficient reason to take legal action” – let’s hope the ESB is focussing on the other definition, “able to be done or acted on”.

Where things are at now

The current framework is shown in the Australian Energy Market Commission’s Coordination of Generation and Transmission Investment (COGATI) Options Paper:

Energy Networks Australia recognises concerns regarding affordability and the need to guard against over investment. However, it is important to note that ISP identified transmission investment is driven by changes on the supply side, whereas the current regulatory framework is designed to effectively meet consumer demand. Given this, it is not reasonable to expect the current framework to be capable of adequately:

- managing the transformation underway in our generation sector

- promoting wholesale market competition; and

- lowering power prices.

Reform is required, with a focus on consumer outcomes, so the COAG Energy Council’s recognition of the importance of progressing the ISP is welcome news. The current regulatory framework will not deliver timely and coordinated generation and transmission investment to best serve the long term interests of Australian energy consumers.

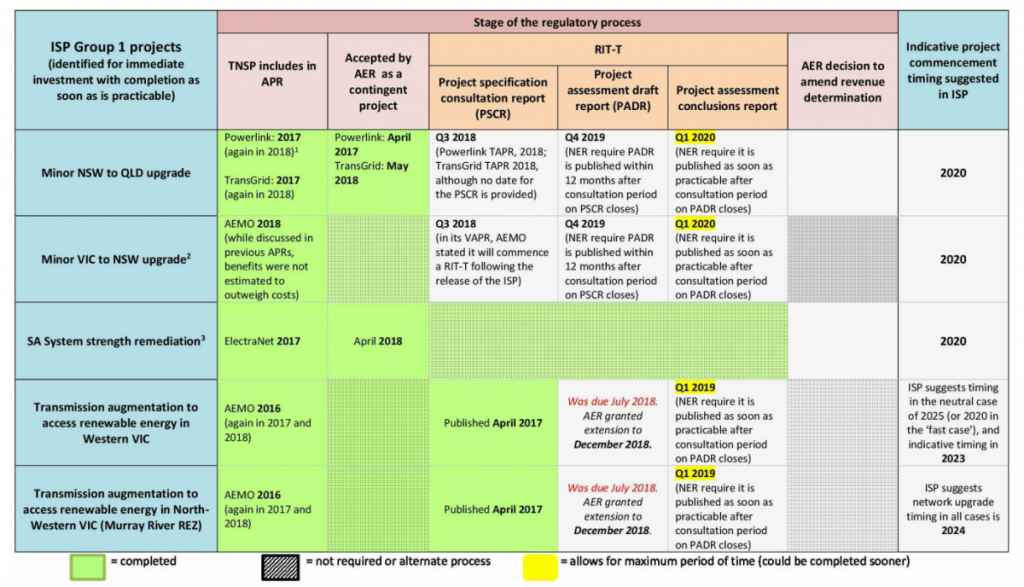

Some projects more urgent than others

Already AEMO is highlighting transmission development that is urgent and the current sequential regulatory processes will not support implementation by the ISP-identified dates. The COGATI paper outlines the progress of these Group 1 projects:

Networks are keen to work with the ESB and the relevant regulatory bodies to ensure that these ‘no regrets’ Group 1 (and Group 2) transmission projects are subjected to an appropriate cost benefit analysis while being progressed in a timely and efficient manner for the benefit of electricity consumers.

verall role of the Integrated System Plan

The AEMC COGATI paper is focused on establishing a regulatory framework that ensures AEMO’s future ISPs are actionable.

Submissions to the options paper generally supported AEMO’s role in publishing an ISP that employs robust cost-benefit analysis to identify national, strategic transmission projects that demonstrably benefit electricity consumers in net present value terms.

Energy Networks Australia reiterated its strong support for AEMO’s role in publishing an ISP that facilitates the efficient coordination of generation and ‘least regrets’ transmission investments for the benefit of customers. Our members – which include transmission and distribution networks – remain committed to delivering the best whole-of-system energy solutions for electricity customers. Energy Networks Australia regards robust cost-benefit analysis and effective engagement with stakeholders as essential pre-requisites to achieving this objective.

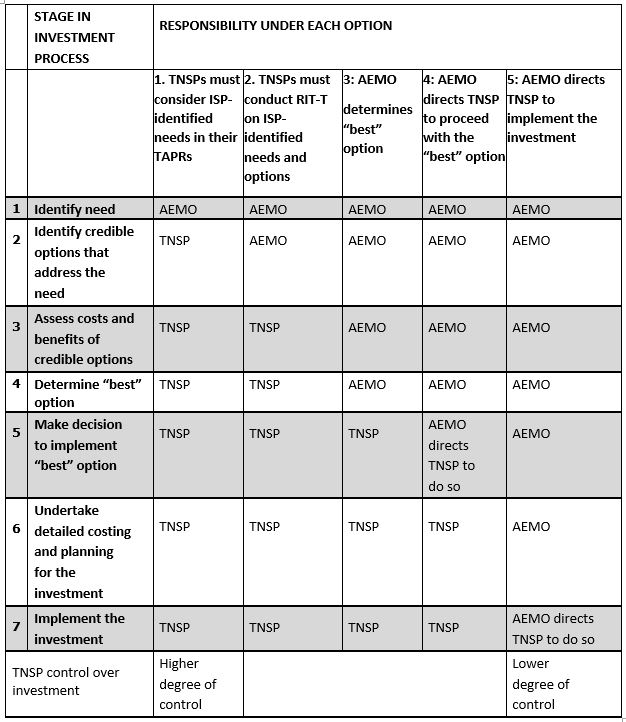

In relation to implementing an actionable ISP, the COGATI paper examines how the current Regulatory Investment Test – Transmission (RIT-T) provisions could be allocated between AEMO and the transmission network service providers (TNSPs) in relation to the appraisal of national, strategic transmission projects. The five options considered range from AEMO taking a very limited role in the investment process (Option 1) through to AEMO making the investment decision and procuring the required service (Option 5).

Views in submissions were divided on support for the options, from continuation of a market led approach and an ISP that provides guidance only, to a ‘middle ground’ option that leverages AEMO’s expertise in relation to national planning, while ensuring that TNSPs local knowledge, regional planning expertise and skills are leveraged to optimise project scoping and delivery and maintain clear accountability for regional transmission service outcomes.

Of the submissions reviewed, there was no support for option 5, where TNSPs are directed to make investments. Several submissions did not see this as practical or in the long term interests of consumers. Energy Networks Australia supports a middle ground position, in which AEMO progresses the project identification and assessment in accordance with its existing role as the independent national transmission planner. Energy Networks Australia does not support an extension of AEMO’s role to procuring the preferred solution (Option 5). This option would essentially convert AEMO from national planner to national TNSP, which would necessitate major changes to the regulatory framework and create significant resourcing challenges for AEMO. Such a radical change to AEMO’s role would dilute accountability for regional transmission service outcomes and is not warranted in order to give effect to an actionable ISP.

Energy Networks Australia strongly supports AEMO using its expertise as the independent national planner to identify the preferred national, strategic transmission projects in the ISP. AEMO’s robust cost-benefit analysis should make extensive use of the available planning information, including the TAPRs, in order to maximise the net benefit to customers.