No Ashes battle here: the Poms agree with us on fairer power pricing

It’s globally understood: the need for smarter, fairer approaches to how we charge for electricity. It’s clear that real customer acceptance of proposed changes will be a key to a successful transition, but poorly designed market frameworks or government interventions are limiting progress on tariff reform – and it’s consumers who’ll be worse off as a result.

Smarter, fairer use of the grid

Earlier this month, UK Regulator OFGEM released two working papers reviewing how networks are used, how costs are reflected in charges, and how these costs are recovered from customers. Andrew Wright, OFGEM’s senior partner for energy systems, explains in his blog that these reforms aim to encourage fair network charges for all users.

In Australia, widespread use of air-conditioners and residential solar have driven the need for changes to network pricing. In the UK, however, regulators are concerned about the future impact of electric vehicles (EVs) on the network. OFGEM estimates that upwards of £6bn in reinforcement might be required across GB by 2050 to accommodate EVs without changes to pricing, incentive and system operation arrangements for networks to orchestrate energy flows.

Mr Wright notes the review will consider current network pricing arrangements with on-site generation such as solar and wind.

“This is not about adding new costs for businesses and households. Instead it is making sure that these costs are spread efficiently and fairly among all network users…

…A customer who takes all their electricity from the grid will pay a larger share than a customer who generates some of their electricity on their own site, for example with solar panels, even though they both have the same ability to access the system. When one set of consumers pays less, it increases charges for others, including those that are in vulnerable circumstances.”

The Australian Experience

In its preliminary report to the Inquiry into Retail Electricity Prices, the ACCC stressed the urgency of improved fairness in pricing design. The ACCC’s analysis of residential price increases highlighted impact disparity across the customer base.

Network tariff structures can mean that some customers are paying more than their fair share of network costs. The design of network tariffs, particularly for small customers, largely link charges to a customers’ overall usage. But it is a customer’s peak (rather than overall) usage that drives the majority of network costs

….[M]oves towards cost reflective network tariffs will provide a means of providing better signalling to customers and retailers at times of high demand and high pricing.”

Though energy prices are rising overall, Energy Networks Australia’s submission to the ACCC inquiry showed that network prices have fallen significantly in recent times and have gone some way to absorb both increases in wholesale and retail costs and increases in government schemes.

The submission emphasises that because current pricing structures provide distorted signals to customers, the impact on customers paying more than their fair share of network costs will continue to grow if we don’t transition to fairer pricing structures as soon as we can.

The submission cited the findings of the Energy Networks Australia/CSIRO Electricity Network Transformation Roadmap, which suggest that with action there is the potential for significant customer savings of approximately $414 per annum by 2050. However, these benefits depend on numerous factors, including networks providing price signals to retailers through restructured network tariffs that are, by design, efficient and fair.

The end-to-end delivery chain from network to retailer right through to customer must be unblocked so that efficiency and value can flow freely. Networks must assign tariffs to retailers that provide signals, which can be incorporated into retail prices for customers (or managed across the retailer’s portfolio) with appropriate support measures and safeguards to ensure fair outcomes. This in turn requires action to increase the penetration of smart meters, and removal of barriers so that customers can be transitioned to cost reflective tariffs.

In its final report, the ACCC will investigate barriers to fairer pricing outcomes to customers, notably:

- the limited roll out of smart meters to residential and small business customers in non-Victorian jurisdictions

- some Government decisions to mandate tariff uptake on a voluntary basis only

- whether retailers have sufficient incentives to pass through and promote cost reflective network pricing in retail offers

However, the ACCC recognises that the biggest challenge is arguably one of design and acceptance of any pricing arrangement changes for customers.

The success factor

Networks have taken up the challenge of how to get customers more interested and accepting of changes to pricing arrangements. Energy Queensland, TasNetworks, Western Power, Essential Energy, Endeavour Energy and Ausgrid have been working with Energy Consumers Australia and City Smart on a Tariff Reform Research Project to understand the changing needs of residential energy consumers in the information age, and the implications for time-of-use electricity pricing. The project gives householders an opportunity to have their say so we can better understand energy consumer motivators and barriers.[1]

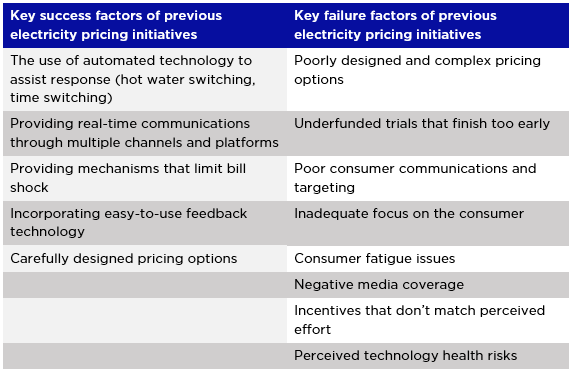

The summary report finds that there are some critical factors to be considered in introducing new electricity pricing plans.

Engage early, often and widely

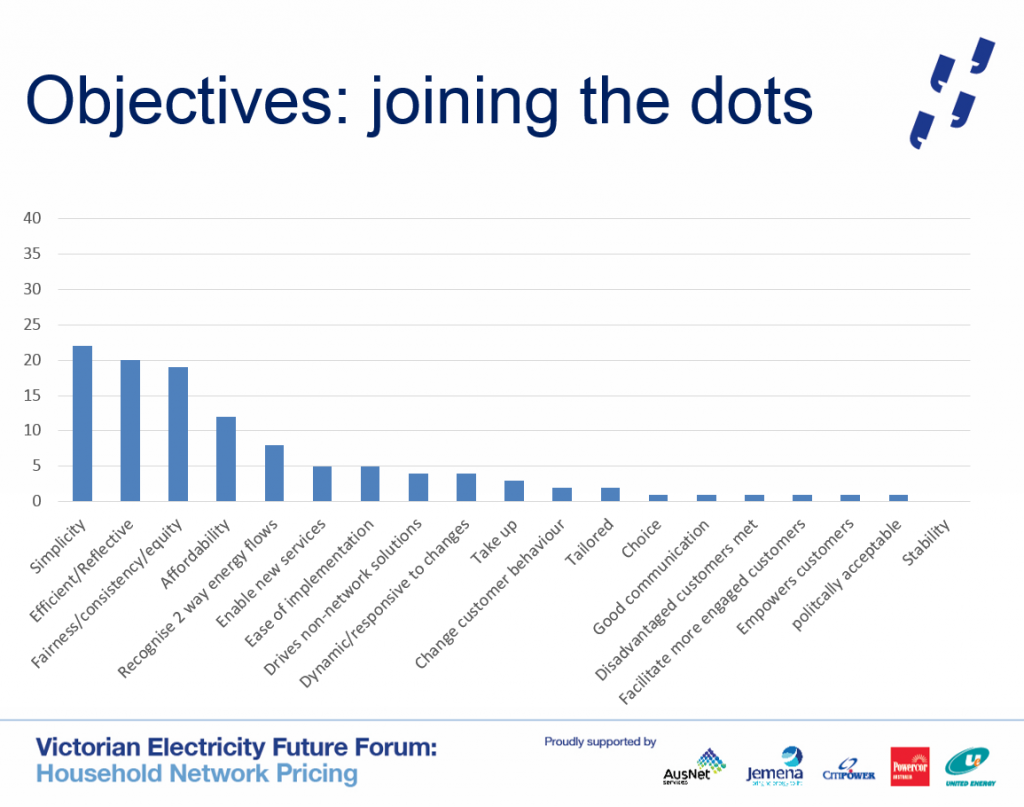

Earlier this month, around 60 people representing a mix of consumer groups, regulators, government, retailers and network businesses attended the Victorian Electricity Network Future Forum in Melbourne to collaborate on the challenges and opportunities that may arise from household electricity network pricing changes.

The group discussed the key priorities and tensions surrounding network pricing reform and identified key pricing objectives. The top five objectives from a list of 93 suggestions included: simplicity; efficient and reflective; fairness, consistency and equity; affordability; and the recognition of two-way energy flows.

Dr Larissa Nicholls from RMIT noted that customers have a lack of confidence in what is driving their existing tariffs and that any added complexity discourages customer engagement or willingness to switch.

The research suggested that a general distrust of the energy sector drives disengagement. RMIT suggested that a focus on simplicity over complexity is likely to encourage engagement and build trust. Feedback from the Victoria forum was that collaboration from across the sector was a strong first step towards trust building.

Experience of energy network businesses supports the research from RMIT and QUT. All energy networks are engaging with customers to develop fairer pricing arrangements that also meet customer needs.

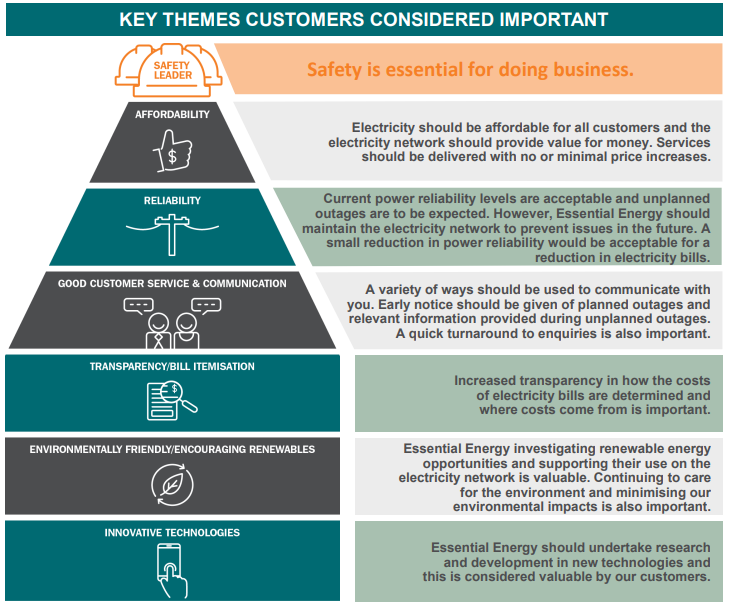

During May and September 2017 Essential Energy held 14 deliberative forums attended by more than 1,000 customers, and held online interviews with an additional 2,000 customers across NSW. A key finding was that customers wanted more information on energy consumption and choice, particularly to help them better understand their usage and pricing.

For some businesses, customer engagement included trialling different pricing products to gain feedback before wide scale rollouts commence. Outcomes and insights from various pricing trials have been used to inform Energy Queensland’s proposed network tariff reforms that apply from 1 July 2020. These insights include the impact of seasonality, levels of customer communication and transparency of the impact on customer bills when network tariffs are translated into retail tariffs.

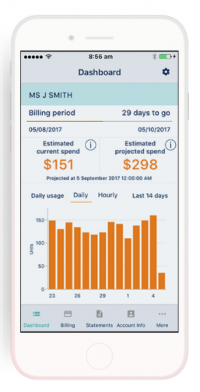

Horizon Power recently completed an innovative demand based pricing trial in Port Hedland involving 400 customers. Similar to the way a mobile plan is structured, customers were able to view their live consumption patterns through their phone app, and adjust it if they were reaching a predefined limit of energy use. Horizon Power is now working with government to establish a demonstration phase of this pricing model, MyPower, allowing customers in other towns to opt-in and participate.

Victorian distribution networks have developed tools that that make use of information available from smart meters with functions that allow customers to view their electricity use over time and to identify ways to reduce bills and become more energy efficient. CitiPower and Powercor have developed the myenergy dashboard, Jemena has its Electricity Outlook portal, AusNet Services has the myHomeEnergy portal and United Energy has the Energy Easy Portal.

ActewAGL has engaged with its customers on the opportunities and challenges associated with its pricing plans through their Energy Consumer Reference Council (ECRC). Western Power sought customer insight for tariff design and trade-offs consumers are willing make in their electricity usage through an online survey (500 customers) and series of workshops (26 customers across 3 workshops).

Engagement recognised

This week, finalists in the inaugural Energy Consumer Australia Consumer Engagement award have been announced. SA Power Networks, ElectraNet, Australian Gas Networks, TasNetworks and Mondo Power have been recognised as leading consumer engagement for energy networks. A key feature of three finalists – Australian Gas Networks, ElectraNet and TasNetworks, is their early approach to engagement. SA Power Networks adopted a highly regarded deliberative process to develop their 2017-2020 Tariff Structure Statement. AusNet Services with Mondo Power and Totally Renewable Yackandandah have been recognised for customer engagement in transforming the electricity grid. The recipient of the award will be announced on the 29th November in Canberra.

[1] Russell-Bennett, R., Mulcahy, R., McAndrew, R., Letheren, K., Swinton, T., Ossington, R., & Horrocks, N. (2017). Taking advantage of electricity pricing signals in the digital age: Householders have their say. A summary report. Brisbane: Queensland University of Technology.