A Victorian energy season: Five decisions in one day

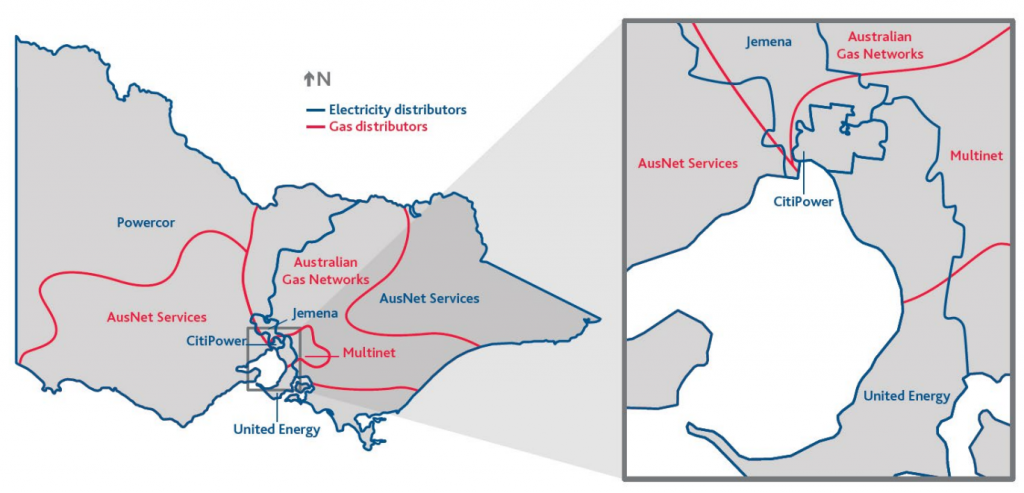

The five Victorian electricity distribution final determinations were released last Friday by the Australian Energy Regulator (AER) after extensive consultation and consumer engagement. The determinations will set the revenue controls for Powercor, CitiPower, United Energy, Jemena and AusNet Services and relate to more than three million residential customers. The determinations cover the regulatory control period from 1 July 2021 to 30 June 2026.

Figure 1 – Map of Victorian electricity distribution boundaries[i]

Lower Revenues approved

The final determinations allow the Victorian electricity distributors to recover about $11.8 billion in revenue, on average $2.4 billion a year. This is notably between 1.0 and 7.8 per cent lower than allowed revenues over the 2016-20 regulatory period in real terms, predominately from lower rates of return and lower costs of corporate income tax. This is expected to deliver real price falls for network services for millions of Victorian customers.

The AER’s final determinations on revenue and tariff structures will form the basis of the distributors’ annual pricing proposals to the AER, with the 2021-22 network pricing proposals due this month.

Capital expenditure – is the replacement challenge being met?

The Australian Energy Regulator (AER) has allowed $5.24 billion worth of capital expenditure across the five networks out to 2025-26, $233 million lower than requested in revised proposals.

The major contributor to differences between the final decisions and revised proposals is the AER’s reduction in replacement expenditure allowances. Across CitiPower, Powercor and United Energy, $300 million was requested to replace aging wooden poles while the AER allowed only $215 million.

Aging network assets are a growing concern nationally as the average age of networks across the National Electricity Market is increasing because replacement isn’t keeping up relative to the total network asset base. Leaving this trend unaddressed creates risks for asset failure and reliability, which are well represented by the bathtub curve.

Operating expenditure – recognising changing costs

On operating expenditure (opex), the AER accepted all five revised proposals, totalling $4.7 billion to 2025-26.

The operating expenditure allowances include a $170 million step change for increases in insurance premiums to meet changing market prices and help financially protect customers against risks to network damage caused by major natural events such as bushfires and storms. Cost pass through events for further insurance premium increases requested by Victorian distributors were rejected by the AER on the basis that this may remove incentives to deliver efficient outcomes.

The 2019-20 Australian bushfires burned between 24.3 to 33.8 million hectares – an incredibly large area[ii]. For comparison, Victoria’s total land mass is around 22.7 million hectares. The Australian bushfires, with help from the 2020 California bushfires, brought a reassessment of the network risk profile, leading insurance firms to significantly increase insurance premiums.

Role of Customer engagement and consultation

The Victorian determinations featured extensive and thorough consultation with customers right from the very beginning. Jemena engaged with its People’s Panel[iii], CitiPower, Powercor and United Energy undertook its ‘Energised 2021-26’ engagement program[iv], while AusNet engaged the New Reg partnership.

Network businesses around the country are leading customer engagement programs to better understand what their customers value and give them input into the decision-making process. This ensures the network better meets customer needs in terms of price, reliability and services.

The AER’s newly developed consumer engagement framework assesses the nature of engagement, its breadth and depth and whether impacts are evidenced, while also comparing to AER technical analysis. While the AER recognised the positive shift by Victorian distributors in improving consumer engagement, it prioritised the results of its technical analysis for three out of five networks, stating that “the quality of a distributor’s consumer engagement informs the nature of our technical assessment but does not displace it”.

New Reg Trial reaches the critical point

The AER’s final determination for Ausnet is also a milestone in the collaborative New Reg partnership involving Energy Consumers Australia, the AER and ENA. This project aimed to design a framework for trialling and enabling innovative engagement approaches as well as identifying opportunities for regulatory innovation.

The final decision recognises the positive impact of New Reg’s trial process on AusNet’s proposal. It highlights the innovations made possible by the work, including a new Customer Service Incentive Scheme approved by the AER that allows customers and networks to better target and reward the outcomes valued by customers.

What’s next?

Lower revenues are expected to result in reductions to network prices come 1 July this year, but we won’t know for certain until the Annual Pricing Proposals are submitted and published. While this is good news for customers, there remain concerns that network assets continue to age and expenditure to replace ageing assets isn’t keeping up.

With improved and extensive customer engagement, it is disappointing that in some cases more weight appears to have been placed on the AER’s technical analysis rather than the consumer voice. Network service providers understand the importance of incorporating customer views and preferences in their plans and will continue to engage with customers.

[i] Reproduced from Essential Services Commission, Victorian Energy Market Report 2019-20 (November 2020), p. 13.

[ii] Royal Commission into National Natural Disaster Arrangements, Royal Commission into National Natural Disaster Arrangements Report (October 2020), p. 115.

[iii] The People’s Panel is a representative demographic sample of residential customers within Jemena’s network.

[iv] The Energised 2021-26 engagement program engaged 11,000 customers and stakeholders through 2.5 million ‘touch points’ to learn about and incorporate their customers’ values and preferences.